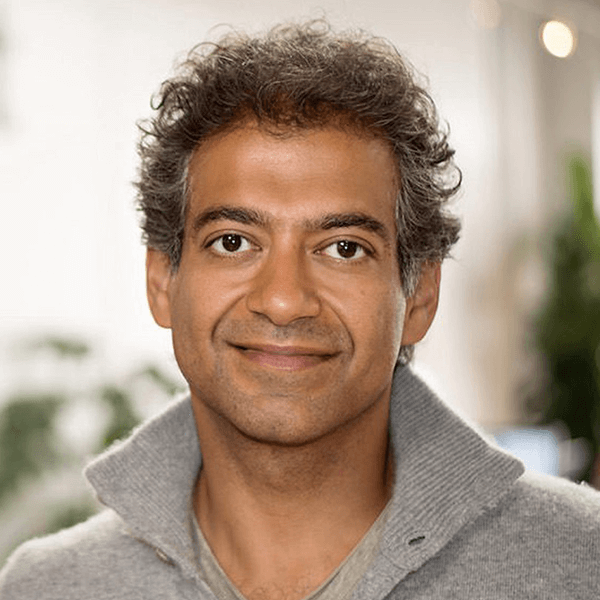

Warren Buffett, often referred to as the "Oracle of Omaha," is one of the most successful investors of all time. Born in 1930 in Omaha, Nebraska, Buffett displayed an early knack for finance and investing, making his first stock purchase at the age of 11. He studied under Benjamin Graham at Columbia Business School, where he adopted Graham's value investing philosophy—a strategy that focuses on undervalued stocks which represent a margin of safety and have potential for substantial growth. Buffett is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company through which he has amassed significant holdings in various major companies, demonstrating unparalleled prowess in maximizing investment value and compounding wealth over decades.

❝Read 500 pages like this every day. That's how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.❞ — Warren Buffett

Buffett's commitment to reading has been a cornerstone of his investment strategy and personal habits. He famously spends about 80% of his day reading—ranging from financial reports to historical biographies and corporate documents—believing that this habit is crucial to making informed investment decisions. His extensive reading routine underscores his belief in continuous learning and staying well-informed about the economic environment and potential investment opportunities. Buffett advocates that reading widely is essential to successful investing because it contributes to a deeper understanding of the market, its trends, and broader economic factors.